Recent Federal Government decisions to reduce university funding while pushing greater numbers of students through the tertiary sector are the latest challenges to the business models of our universities. In recent years they have been asked to grow in size, service a diverse range of stakeholders, help to implement multiple government policy initiatives, improve in quality, and raise more of their own funds, all while the effective level of government support has declined on a per student basis. The diversified nature of the individual universities has allowed them to accommodate most of these requests, albeit with varying degrees of stress. One way this has been achieved is by taxing the low-cost faculties like business to subsidize higher cost faculties like medicine and science. This strategy has worked quite well because: (a) business students, particularly full fee paying foreign students, don’t realize that a large proportion of their fees (approximately 50% in many cases) are being used to subsidize other parts of the university; (b) the business school faculty are generally slightly better paid relative to their counterparts in other faculties; (c) it is the sciences that drive the world rankings of university quality to which the vice chancellors are held accountable; (d) the business community has generally been apathetic and uninvolved with the universities and business schools, and (e) alumni and other potential supporters do not form an effective and engaged stakeholder group who would question such cross subsidization since they too are apathetic and have no stake in maintaining the reputation of the university. In essence, subsidies from overseas business students in Australian universities are what allow the Australian university system to operate.

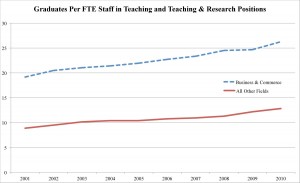

However, this is neither a sustainable business model nor is it desirable from the long run standpoint of Australian society. It is not desirable because it underinvests in business education and research, both of which are fundamental drivers of a healthy economy. It also fosters a dependence mentality in the faculties that receive the subsidies. Dependency crowds out innovation and self reliance – two things that foster quality and the drive for change (See Charts Below).

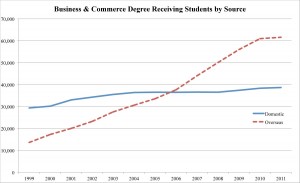

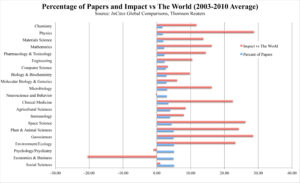

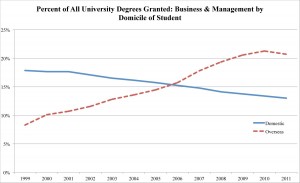

The model is also not sustainable. In 2011, 20% of all university degrees awarded to domestic students were in ‘management and commerce’ (slightly over 38,000 degrees). However, the comparable number for overseas students was 57% of degrees awarded (slightly over 61,000 de grees). Of the 489,000 students commencing their studies in 2011, 70% were domestic students. However, of 145,000 overseas students more than 50% were studying business! Anyone with any knowledge of the operations of our business faculties knows that the system is stretched to the limit with decreasing academic quality brought on by large class sizes, a greater number of casual lecturers, and decreasing intellectual quality, as evidenced by data from both the ERA exercise and data from Thomson Reuters (where Australian academic impact is rated at approximately 20% below world average in terms of citation impact; i.e., quality — see, ERA: Perilous for Economics and Commerce and the graph below from that article).

grees). Of the 489,000 students commencing their studies in 2011, 70% were domestic students. However, of 145,000 overseas students more than 50% were studying business! Anyone with any knowledge of the operations of our business faculties knows that the system is stretched to the limit with decreasing academic quality brought on by large class sizes, a greater number of casual lecturers, and decreasing intellectual quality, as evidenced by data from both the ERA exercise and data from Thomson Reuters (where Australian academic impact is rated at approximately 20% below world average in terms of citation impact; i.e., quality — see, ERA: Perilous for Economics and Commerce and the graph below from that article).

Michael Chaney, in a speech launching Australia – Educating Globally report revealed a vision where Australia would be educating 700,000 overseas students by 2030. If 57% of these students studied business (which is the rate for newly enrolled overseas students), this would entail doubling the capacity of our already overstretched business schools (which currently educates 170,000 business students). What is clear to us is that doubling an already crowded system, staffed by an aging workforce, which is underperforming intellectually by world standards, is a recipe for organizational disaster and intellectual and pedagogical mediocrity.

Michael Chaney, in a speech launching Australia – Educating Globally report revealed a vision where Australia would be educating 700,000 overseas students by 2030. If 57% of these students studied business (which is the rate for newly enrolled overseas students), this would entail doubling the capacity of our already overstretched business schools (which currently educates 170,000 business students). What is clear to us is that doubling an already crowded system, staffed by an aging workforce, which is underperforming intellectually by world standards, is a recipe for organizational disaster and intellectual and pedagogical mediocrity.

So what can be done? In the current political climate grumbling to the government or to each other is unlikely to be successful. The Vice Chancellor of one of the G-08 universities recently sent us an email asking us to do just this. Also, asking the universities to change their cross-subsidy business model is fruitless. If the low cost faculties were to receive a significant increase in their internal funding at the expense of other parts of the university, the universities would tear themselves apart. Asking business and alumni to make significant donations to universities is also problematic. Many US universities rely on business school alumni but few alumni in Australia would be prepared to donate to institutions where there is a lack of clarity as to how the funds are used and where the operations are structured around back door cross subsidies that are never revealed to the universities’ public stakeholders.

We suggest an out-of-the-box solution that would be an opportunity for building a national icon, create opportunities for local governments and corporate interests to align, and provide a foundation for building true world class excellence in business and management (as well as potentially in law and economics). At the same time it would serve to reduce the undue stress being placed on our existing university structure.

We feel that it is necessary for Australia to have a professions only university − within which would sit the management disciplines, economics, accounting and law as separate units. There are a number of examples of these institutions that are highly successful, and, in many cases, stand as national icons. Examples include ESSEC (France), Copenhagen Business School (Denmark), WHU and ESMT (Germany), St. Gallen (Switzerland), Wirtschaftsuniversität Wien (Austria), NNH and BI-Oslo (Norway), Stockholm School of Economics (Sweden), Bocconi (Italy), and Singapore Management University.

The institution we are proposing would be established as an independent private foundation with all the rights of an Australian university but with a board structure that is representative of the key investors and stakeholders. Good examples of this structure are INSEAD in France and ESMT in Germany.[1] Our initial estimate is that this would require approximately $300-$400M over a 10-year period with the funding and in-kind contributions coming from three sources, the Federal Government, the business community, and the New South Wales and Victoria State Governments. Such an investment is relatively minor, particularly in light of the impact on the ‘efficiency dividend’ being proposed as part of the Gonski Education Reforms. We would envision two campuses, one in Melbourne – the core law and economics faculty, and one in Sydney – the core management faculty and accounting.

We believe that this proposal is a significant win-win for Australian society and the business community.

It is a win for the society because effective and efficient education has significant payoffs. These arise not just in more effective business practices but greater innovation and a more dynamic society. In addition, such a structure will make Australia more competitive in drawing in student and academic talent. Currently, Australia’s positioning vis-a-vis its appeal to students is suffering. The best students are increasingly being attracted to better-capitalized overseas institutions that are unlikely to tax their business faculties at anywhere near the rate seen in Australia. Academically, most Australian business schools have a mediocre research reputation and it is increasingly difficult to convince younger scholars to risk a career here. Given the aging structure of our academic profile such a trend is worrying, as the best students rarely want to be taught by anything but the best faculty.

It is a win for the business community because it ensures an institution dedicated to providing not just world-class education but education for value. Many business groups have complained over the years about the poor quality of business school education in Australia. Having a well-trained workforce is critical to Australia’s success. Having an institution that draws in overseas talent is a key if the society needs skilled immigration to grow. In addition, a professions only institution would be a magnet for business and academic linkages. Currently, Australia business schools have very little interaction with the business community and are generally ignored by the big end of town. Such linkages are critical for not only effective education but also potential sources of real innovation.

In essence, Australian universities are perhaps the country’s last living examples of unrelated diversified cross-subsidizing conglomerates. What we know about these structures is that they are ripe for disintermediation when the cross-subsidies get out of hand. We also know that they are less likely to be organizationally innovative. Hence, if we are going to innovate around management education and scholarship it is more likely that we will be able to do so ‘outside the box’ than ‘inside the box’. In our view, a dedicated professions only institution has the opportunity for a massive win-win for a remarkably small investment.

Note: This article was co-authored by Grahame R. Dowling. All data reported is from DIISRTE as given on the Universities Australia website (http://www.universitiesaustralia.edu.au/). Graduates are all those receiving any degree from an Australian University.

[1] INSEAD was established with a grant from the Ford Foundation and its alumni and donation capital are maintained as a foundation in Switzerland. ESMT was founded with more than €100M in funding from the German business community and facilities granted by the German/Berlin government (they are housed in the former DDR offices in central Berlin). Last year ESMT received another significant investment from its initial investors.

Recent Comments